Breaking through the PLC Migration Cost-Justification Barrier

This is the first white paper in Schneider Electric’s Profiting from PLC Migration series of 3, designed to help you understand how to help manufacturers and municipalities evaluate their need for PLC upgrades and implement them with success.

This paper focuses on demonstrating ROI in the context of present and future profitability. The second paper, WHAT A PLC UPGRADE CAN DO FOR YOU, elaborates on the many ways in which modernisation efforts contribute to plant profitability and improve operations, and the third paper, CRITICAL SUCCESS FACTORS IN PLC MIGRATION, focuses on the migration process itself, providing a checklist of the key points to consider to achieve the benefits described before launching a PLC migration venture.

Introduction

In its report titled Automation Systems for Increased Productivity, ARC Advisory Group states that the migration initiatives most likely to get approved are those that can “demonstrate direct support” for business objectives that can have a “significant impact on plant profitability.” In practice, however, direct support for plant profitability most often translates to activities that avoid the worst-case scenario — e.g. unanticipated plant shutdowns — but seldom involve actions that boost the revenue enhancement side of the equation. It is not that no one considers revenue generation important, it is just that proving the connection between automation improvement and profitability has not been easy.

Because of a defensive control system migration justification, more aggressive profitability improvement strategies go untried. Playing it safe in this way may have sufficed in the past, when more stable markets and global conditions enabled many companies to flourish almost despite themselves, but it won’t fly today. The pace of business has increased so rapidly that resting on one’s laurels is no longer a viable business strategy. Fortunately, though, many of the same technology advancements that are driving the heightened press coverage of business today are also delivering new tools that enable more measurable paths to profitability. Real-time accounting, Big Data analytics, the Industrial Internet of Things (IIoT) and many of the other solutions that have dominated the headlines over the past decade are now coming of age and becoming more affordable. Those who take advantage of them will be well-poised for leadership in the new economy.

Real-time accounting

Activity-based accounting and management techniques have traditionally been applied to manage variables that are static, not changing in real time, as are production value, energy and raw material costs. Tracking and controlling those critical components of profitability in today’s dynamic global markets is more like controlling other real-time variables like temperature, pressure and flow.

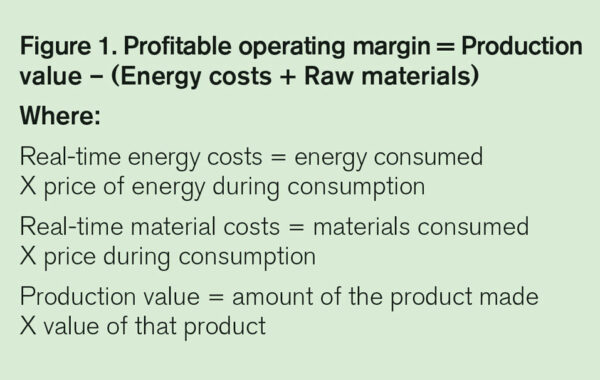

And indeed, control systems and control theory have significant and even vital roles to play. They can provide a profitability index that can help you determine the contribution of each asset to your bottom line and the steps you might take to improve that contribution. As illustrated in Figure1, production value is the amount of product produced multiplied by its market value and the time of production. Real-time energy costs equal the amount of energy consumed times the price of that energy at the time of consumption and likewise, real-time materials costs represent the materials being consumed at their cost at the time preproduction.

Subtracting the total of the energy and raw materials costs from the production value gives you the profit margin, which is a good indicator on the health of your business. This gives you a profitability index that can help quantify the value and timing of controls upgrades as well as other business improvement activities.

It applies across manufacturing operations, since most tend to be energy intensive, raw material intensive, or both.

Bigger and bigger data

From their inception, automation systems had become increasingly capable of chronicling their operations, so much so that as we entered this century, many companies were feeling overwhelmed with information, telling us they didn’t want more data, they just wanted to know what to do with it. At the same time, senior executives were telling us they needed more justification on the value of their existing automation investments. Today, real-time accounting coupled with advanced data analysis tools provides a profitability context to assess the value of targeted plant assets.

The primary sources of industrial data are the sensors, pumps, valves and other devices deployed across the plant and orchestrated by PLCs, PACs or other control systems. Today’s data historians are increasingly capable of gathering and storing more of the data that emerges in the wake of their operations and exchanging it with control systems and industrial applications. Cloud-based historians enable almost unlimited storage capability, significantly expanding the capability to sort, access and retrieve data based on combinations of millions of tags.

Real-time accounting models tag asset specific data based on industry-specific calculations such energy costs, material costs and production value, so historical profitability profiles can be analyzed — often as much as five years prior. Data on production equipment can also be monitored in real time, so that managers, operators and supervisors no longer need to wait 30 days to learn of situations that need correction. And, when, integrated with first principle plant simulation software, this data can be used to forecast trends so that potential problems can be averted before they even happen.

Digital readiness

While much of this capability was present before today’s digitalisation revolution, timing for the convergence is perfect. As more and more devices become interconnected across the internet and in the cloud, the amount of data flowing into those historians is growing dramatically and with the right context, the opportunity for doing old things better and better new things is increasing along with it.

Moreover, the people who will be making those decisions based on that data are digital natives who won’t likely wait 30 days to see what is happening in the plant or sit still for the cumbersome, dated analysis. Fortunately, real-time accounting provides a way to meet the need for speed demanded by the economy and the workforce, without jeopardizing the result.

To conduct real-time analytics, you will need a plant historian and some analytical software that uses Big Data analytics to measure the financial performance of an industrial operation in real time, from the equipment asset level of a plant up to the process unit, plant area, plant site and enterprise levels. These tools work with any process historian to mine both historical and real-time data. They can process that data through the company’s segment-specific accounting algorithms to determine real-time operational profitability and potential savings.

Modern controllers are also designed to take maximum advantage of real-time analytics. Schneider Electric’s M580 Ethernet-enabled process automation controller, (ePAC), for example, uniquely enables embedding of real-time accounting function blocks. This enables operations teams to monitor ongoing operational profitability in real time and make any adjustments necessary to improve profitability. Such workforce empowerment can produce significant ongoing improvements, such as one to three percent production value improvements and three to five percent energy or material cost reductions.

Profit-friendly technology

Once equipped with the right analytical tools, however, the first migration-related question you should ask is not whether you need to modernize your automation technology, but whether you should be migrating your operations to a more profitable place. Once your software is configured around the drivers that are most important to your industry, you can conduct a back cast of operational profitability. To begin, you might start with the same kind of questions you would ask in a traditional hardware migration analysis, following hunches as to which might be the most critical targets for profitability improvement, or proceed systematically, by area, age, or other criteria, which might uncover unexpected sourcesof improvement.

The cement production industry provides a good example of the role that a control system can play in improving profitability. Early in the cement production process, rock is fed into a stone crusher to pulverize it before the next step in the process. It might seem intuitive that production value would correlate positively with the amount of rock fed into the crusher, but there is point at which adding too much rock too fast actually slows the process and demands more energy. With real-time visualiation on the feed and grind controls, the operator can tune the operation for maximum profitability without having to wait for monthly profitability reports and additional analysis. Doing so requires that the controllers on the feed and crushing systems have added adequate bandwidth and realtime communications capability.

Now, let’s assume that the cement producer in the above example is running four rock crushers, is looking to optimise profitability, and is wondering whether a controls upgrade might help. They might access data in their historians, run profitability equations on each, and see which assets are yielding the greatest value. This would provide a benchmark against which they could measure profitability of the other three systems, as well as its own performance overtime. The next step would be to be sure that controllers and communications on each targeted asset were up to the task of enabling real-time control. The projected energy savings alone could justify the controller upgrade.

In the second white paper in this series: What a PLC Upgrade Can Do for You, we explore additional ways in which automation upgrades can contribute to profitability by improving production value, reducing costs through improved asset availability, asset utilisation, labour utilization, operational agility, scalability and readiness for the IIoT, the impact of any of which could be measured and controlled via real-time accounting.

Profitability in control

The real-time accounting provides the smoothest, most cost-effective and lowest-risk model for evaluating the need for and timing of your plant migration. It could, for example, reveal that you are already operating with maximum efficiency, or that your technology is adequate, but can be optimised with advanced control software, or that operators need more training, or a better interface.

With real-time accounting, any discernible physical piece of equipment under control can be monitored: it can be a pump, a heat exchanger, a baking unit, a mixing unit, or whatever. A real-time accounting model guides conversion of process data and business data, moving from the bottom up, aggrandising equipment data units, units to areas, areas to plants and so on. All the data is maintained in the historian so you can analyze in reverse or run it in real time.

Applying the real-time accounting principles discussed will help you determine whether these or other automation technology will help you maintain and improve profitability.

Updating your automation systems brings many other benefits that will impact your day-to-day operations, these include less downtime, easier location of spares, easier maintenance and many other factors.

This series of papers will continue with more details, in the next Marketplace Industrial, with What a PLC Upgrade Can do for You.

And once you have made the decision to upgrade — for whatever reason — careful consideration of all your options will help you do so with the greatest ease, the least cost and the least risk. The third white paper in the series: Critical Success Factors in PLC Migration, will be published in the subsequent edition of Marketplace Industrial.